On Jan 6, 2021, the 10Yr US Treasury Rate increased above 1% for the first time in a bit less than a year. It got me thinking about the impact on society of low interest rates.

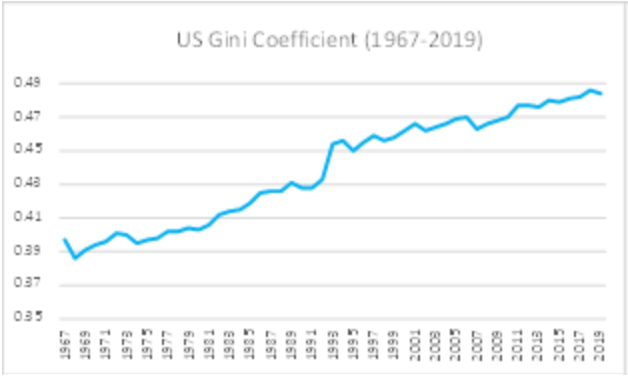

Income inequality is increasing in the US (Figure 1)1. The response from the Left has been to tax the rich. The response from the Right has been to move to Florida or something, it’s not really clear, but don’t tax the rich. Both parties have ignored one of the main causes for the increasing transfer of wealth from poor to rich and young to old: structurally low interest rates.

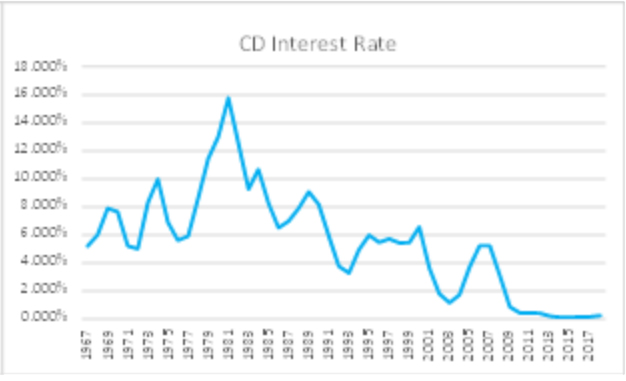

As a little background, while interest rates have been declining since a particularly inflationary period in the late 1970s (figure 2)2, they reached a new form of structural decline after the financial crisis of 2007-2009 when the Fed used Quantitative Easing to drive rates down in the face of a housing-led recession. While it may be fair to say that lowering rates was the appropriate tool at the time, it has been used as an economic catch-all ever since.

Low interest rates benefit the rich by inflating the values of assets, which inherently belong more to the wealthy. While it gives borrowers the ability to refinance at a new low rate, it encourages and necessitates the poor to take out debt in order to afford the assets and opportunities they want, most commonly houses and college educations. Luckily for the world, low interest rates have found a new way to benefit the rich in this most recent cycle. Companies are treated like people by the law, but they tend to make for really shitty people. Like a shitty person, they engage in the most aggressive behavior humanly possible, because in most cases, if the group behavior they are engaging in gets them into trouble, the government will save them. By keeping rates low, public companies have been able to lever up and buyback their stock, which serves little purpose other than inflating their share prices and the stock market. As companies have reduced their need to hold capital3, it has increased the need of governments to step in every time the economy scrapes its knee.

So why has the government not said anything about the effect of low interest rates? Well, unfortunately, similar to companies, members of Congress are also treated like people under the law, and they also tend to make for really shitty people. There are a few self-serving reasons for them not to bring this up. The top 3 I can think of are:

- There is a popular correlation between incumbent elections and the performance of the stock market, and low interest rates help inflate the stock market

- Taxing the rich makes for a better sound bite than ending structurally low interest rates

- The most left-wing members of congress now call themselves socialists, and socialists tend not to have the best understanding the market economy

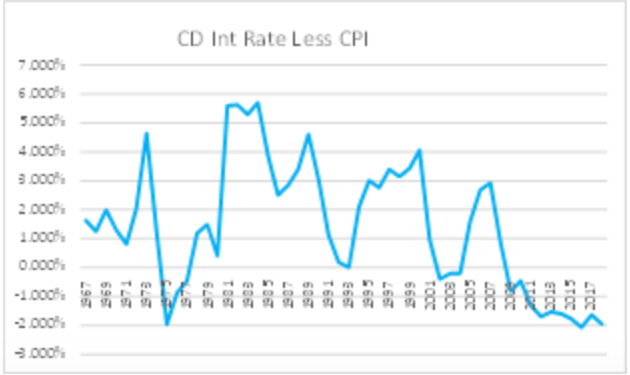

As I understand it, a Millennial is a person who is described by Boomers as valuing work/life balance, caring about experiences more than belongings, and interested in dining out on avocado toast4 rather than eating home cooked meals. In other words, a generation of people that don’t work, and spend too much. Unfortunately, Boomers are treated like people under the law… I’m kidding, some of my best parents are Boomers. But Millennials did enter the work force just as Boomers took down the economy, and subsequently lowered interest rates to spread a 2 year recession over ten years as opposed to taking the pain upfront. The result of lower interest rates was to encourage consumer spending, and keep the recession from becoming the kind of economic event where people jump out of windows on Wall Street and rich people get poor en masse. While low interest rates encouraged consumer spending, they also discouraged savings. For the last 10 years, putting money in the bank has actually made you poorer (Figure 3)5. Without batting an eyelash, Boomers who used low interest rates to save themselves from economic peril now make fun of Millennials for their spending habits. All the while, Generation X’ers6 played the role of older sibling who got out of the house to avoid the abuse and said nothing to help7.

- Source: US Census Bureau & Bloomberg

- https://www.forecast-chart.com/rate-cd-interest.html: Average monthly interest rate for the 6 Month CD

- Hyman Minsky ‘The Great Moderation’. This seems close enough to need to footnote

- Avocado Toast is Delicious (This footnote was paid for by Big Avocado)

- Using the Interest Rates from Figure 2 and subtracting US CPI Non Food and Fuel (Calc’d By Quarterly Avg)

- In all Fairness, Members of Generation X just haven’t been the same since Woodstock 99 Flopped

- This Role is best embodied by Neel Kashkari, the youngest and inexplicably most Dovish member of the FOMC

Leave a Comment